Are you looking for a convenient way to keep track of your income and expenses for tax purposes? A Schedule E form may be just what you need. In this article, we’ll discuss the benefits of using a Schedule E 2026 printable form.

Keeping track of your rental property income and expenses can be a daunting task. However, with a Schedule E form, you can easily organize all the necessary information for tax reporting. By using a Schedule E 2026 printable form, you can streamline the process and ensure that you are compliant with IRS regulations.

Schedule E 2026 Printable

Schedule E 2026 Printable: Simplify Your Tax Reporting

One of the main advantages of using a Schedule E 2026 printable form is that it helps you categorize your income and expenses in an organized manner. This makes it easier to calculate your net income or loss from rental activities and report it accurately on your tax return.

Additionally, a Schedule E form allows you to deduct various expenses related to your rental property, such as mortgage interest, property taxes, insurance, and repairs. By keeping track of these expenses on a Schedule E 2026 printable form, you can maximize your tax deductions and potentially reduce your tax liability.

Another benefit of using a Schedule E form is that it helps you stay organized throughout the year. By documenting your income and expenses as they occur, you can avoid last-minute scrambling during tax season. With a Schedule E 2026 printable form, you can easily update your records and ensure that you are prepared when it’s time to file your taxes.

In conclusion, a Schedule E 2026 printable form can simplify your tax reporting process and help you maximize your deductions. By using this form to track your rental property income and expenses, you can stay organized, compliant, and potentially save money on your taxes. So why not give it a try this tax season?

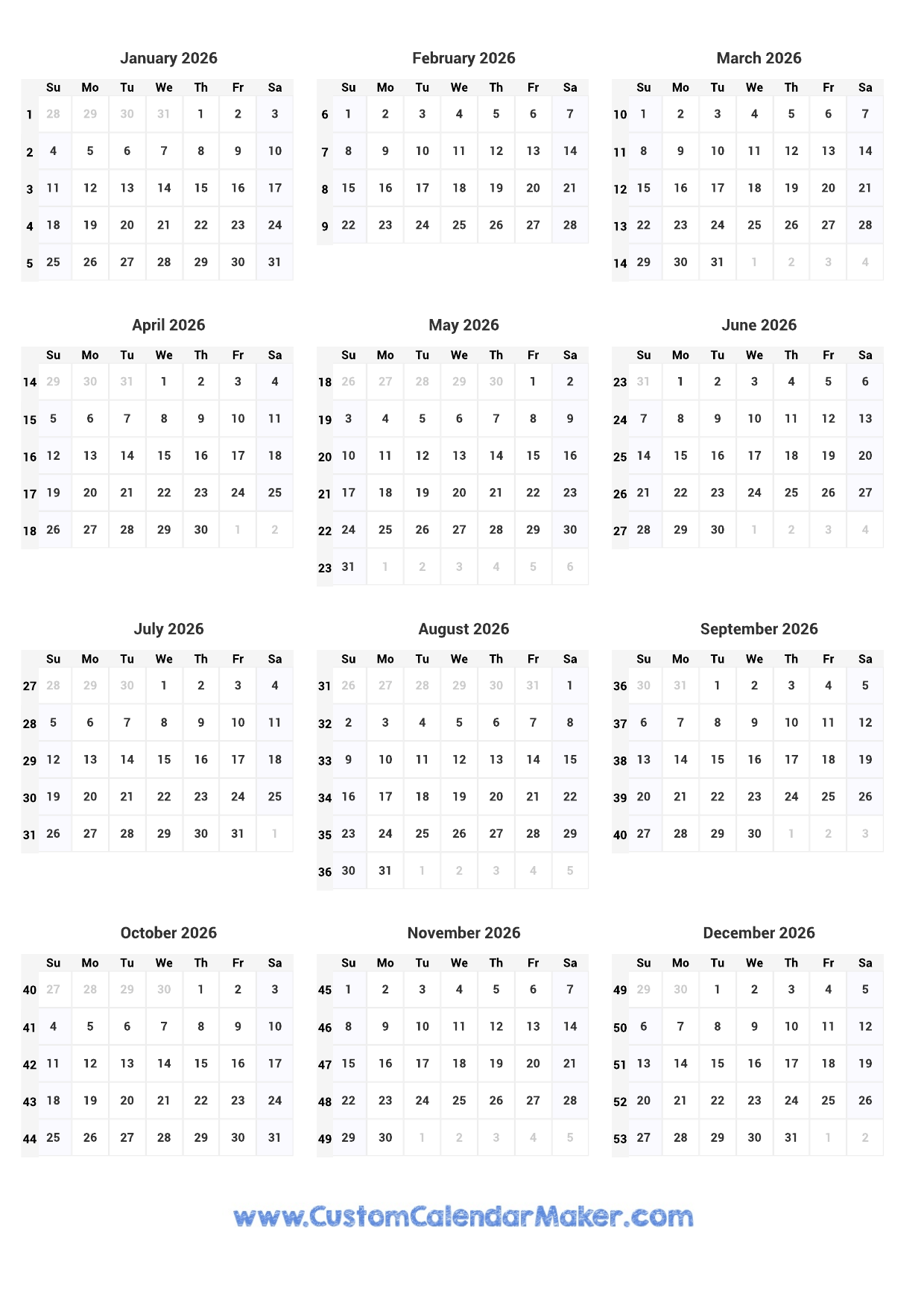

Printable Yearly Calendar 2026 Full Year At A Glance Custom Calendar Maker

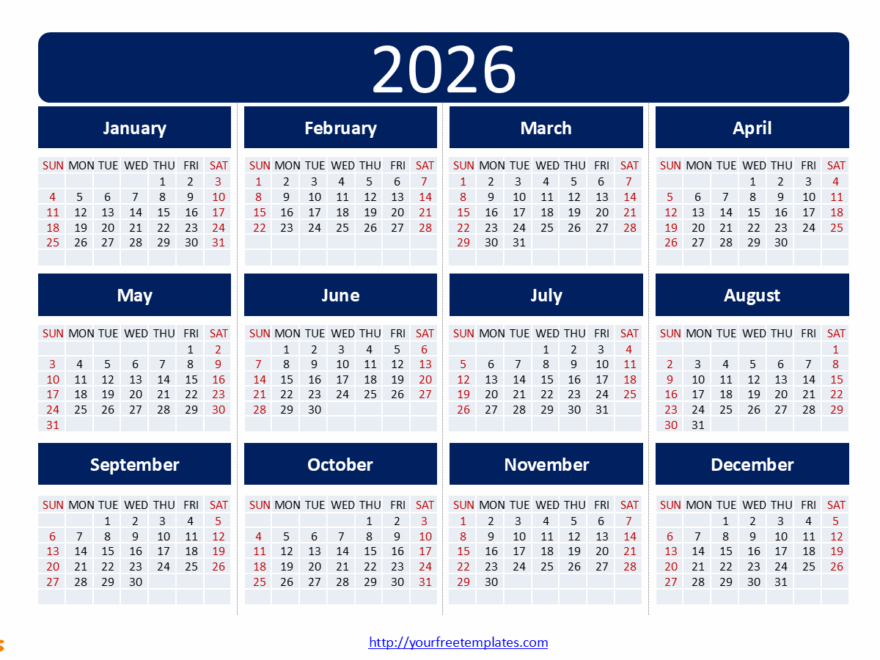

Plan Ahead With The 2026 Calendar Printable Free PowerPoint Template