Are you looking for a Printable Blank Schedule B Form 941 for your small business or personal use? Look no further! This form is essential for reporting tax liabilities for businesses with employees. It helps track the federal income tax withheld from employee paychecks.

Using a Printable Blank Schedule B Form 941 can simplify the process of reporting taxes and ensure accurate calculations. By filling out this form correctly, you can avoid penalties and stay compliant with IRS regulations. It’s a handy tool for businesses of all sizes.

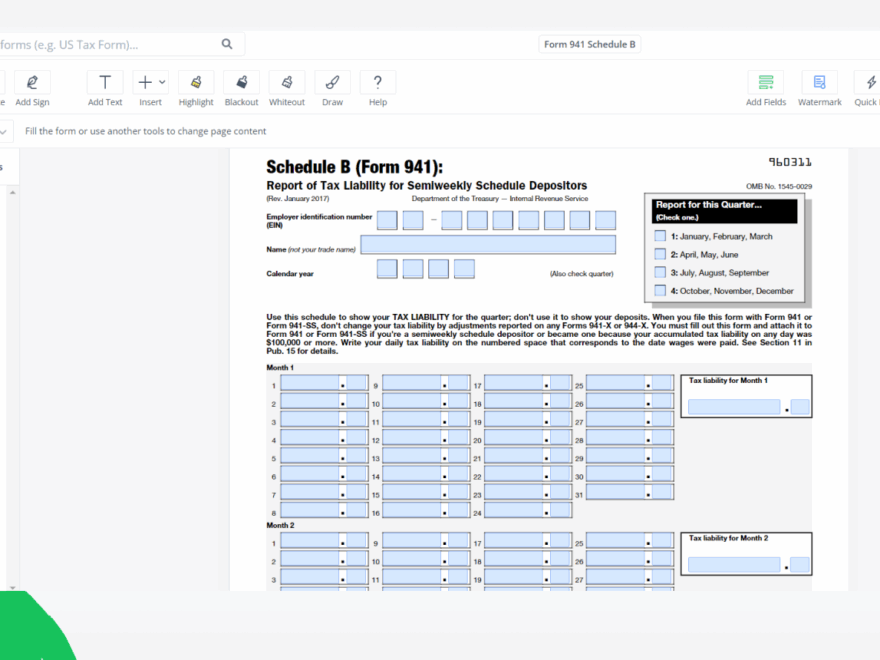

Printable Blank Schedule B Form 941

Printable Blank Schedule B Form 941: What You Need to Know

When filling out a Schedule B Form 941, make sure to include essential information such as your EIN, total tax liability, and the tax deposited for the quarter. This form is crucial for reconciling tax deposits and reporting discrepancies to the IRS.

Having a Printable Blank Schedule B Form 941 on hand can save you time and hassle when it comes to tax season. It’s a simple yet effective way to organize your tax information and ensure accuracy in reporting. Be sure to keep detailed records for each quarter.

Whether you’re a small business owner or self-employed individual, using a Printable Blank Schedule B Form 941 can streamline your tax reporting process. It’s a valuable tool for staying organized and compliant with IRS requirements. Take the stress out of tax season with this handy form!

In conclusion, a Printable Blank Schedule B Form 941 is a must-have for businesses looking to stay on top of their tax obligations. By using this form, you can track your tax liabilities accurately and avoid costly mistakes. Keep your records up to date and make tax season a breeze!

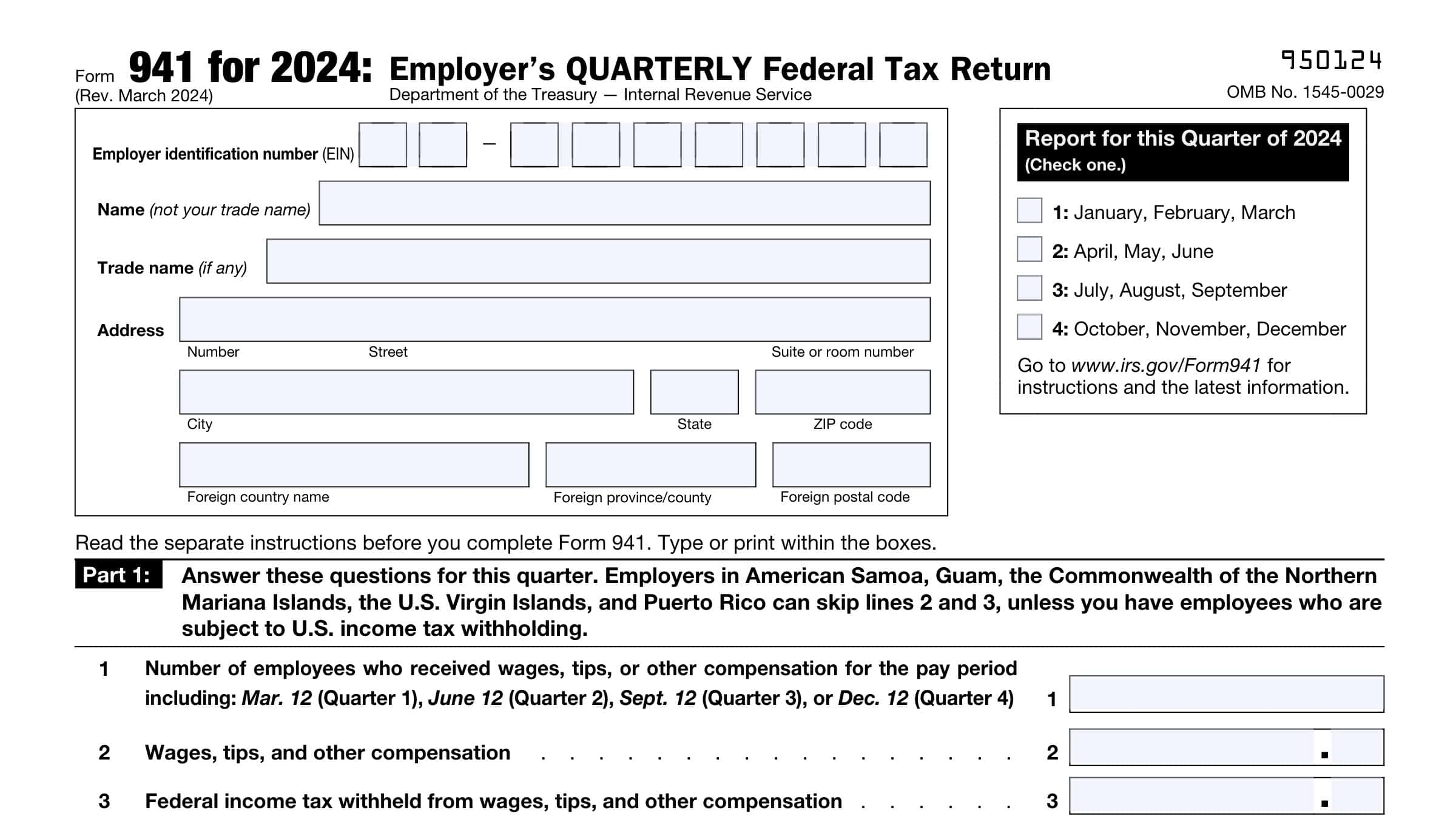

IRS Form 941 Instructions Employer s Quarterly Tax Return

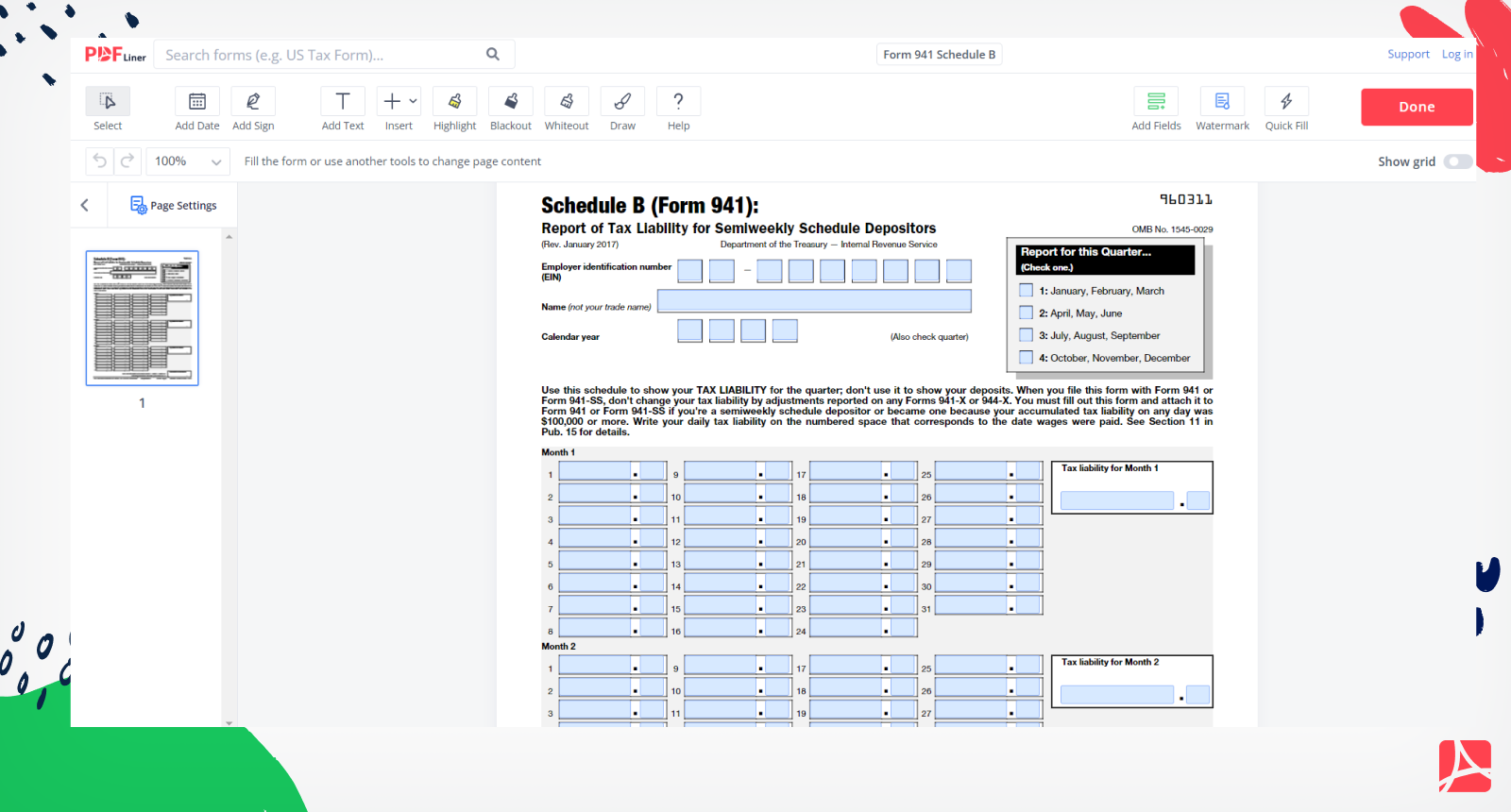

Form 941 Schedule B Print And Sign Form Online PDFliner