Are you in need of a simple and easy-to-use tool to keep track of your loan payments? Look no further! With a printable amortization schedule with start date, you can stay organized and on top of your finances.

Whether you have a mortgage, car loan, or personal loan, having an amortization schedule can help you see how much you owe, how much interest you’re paying, and when you’ll be debt-free. It’s a handy tool for budgeting and planning for the future.

Printable Amortization Schedule With Start Date

Printable Amortization Schedule With Start Date

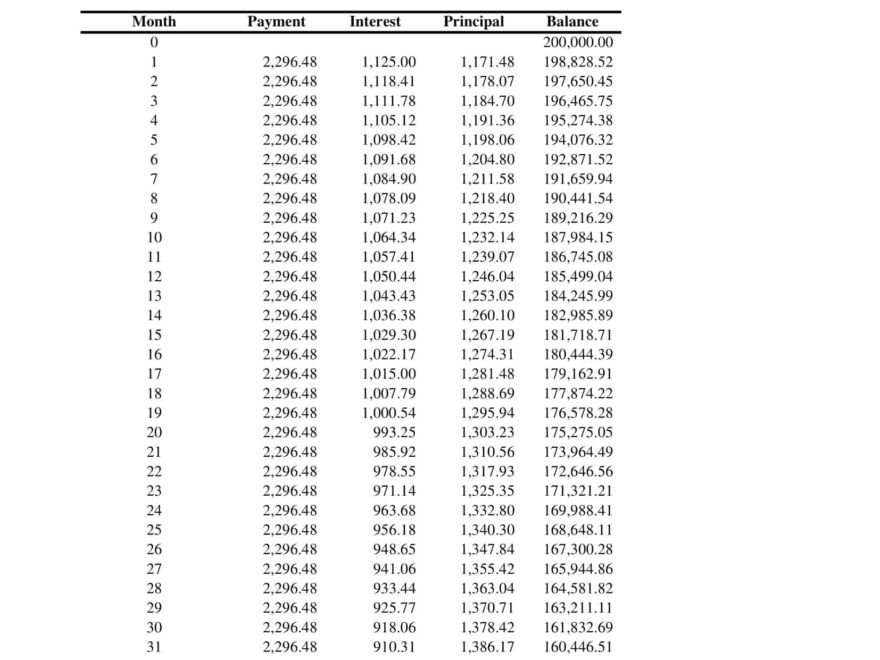

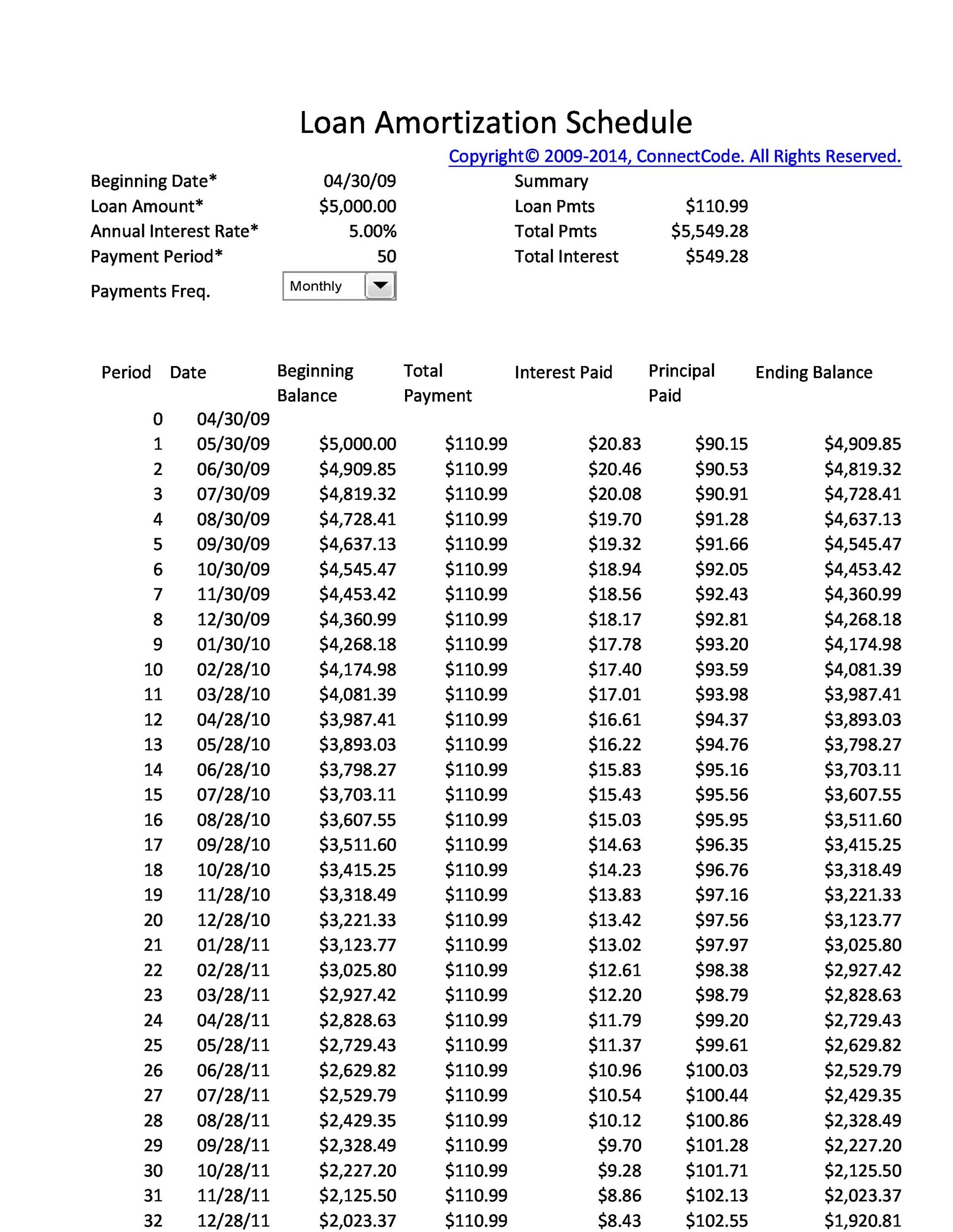

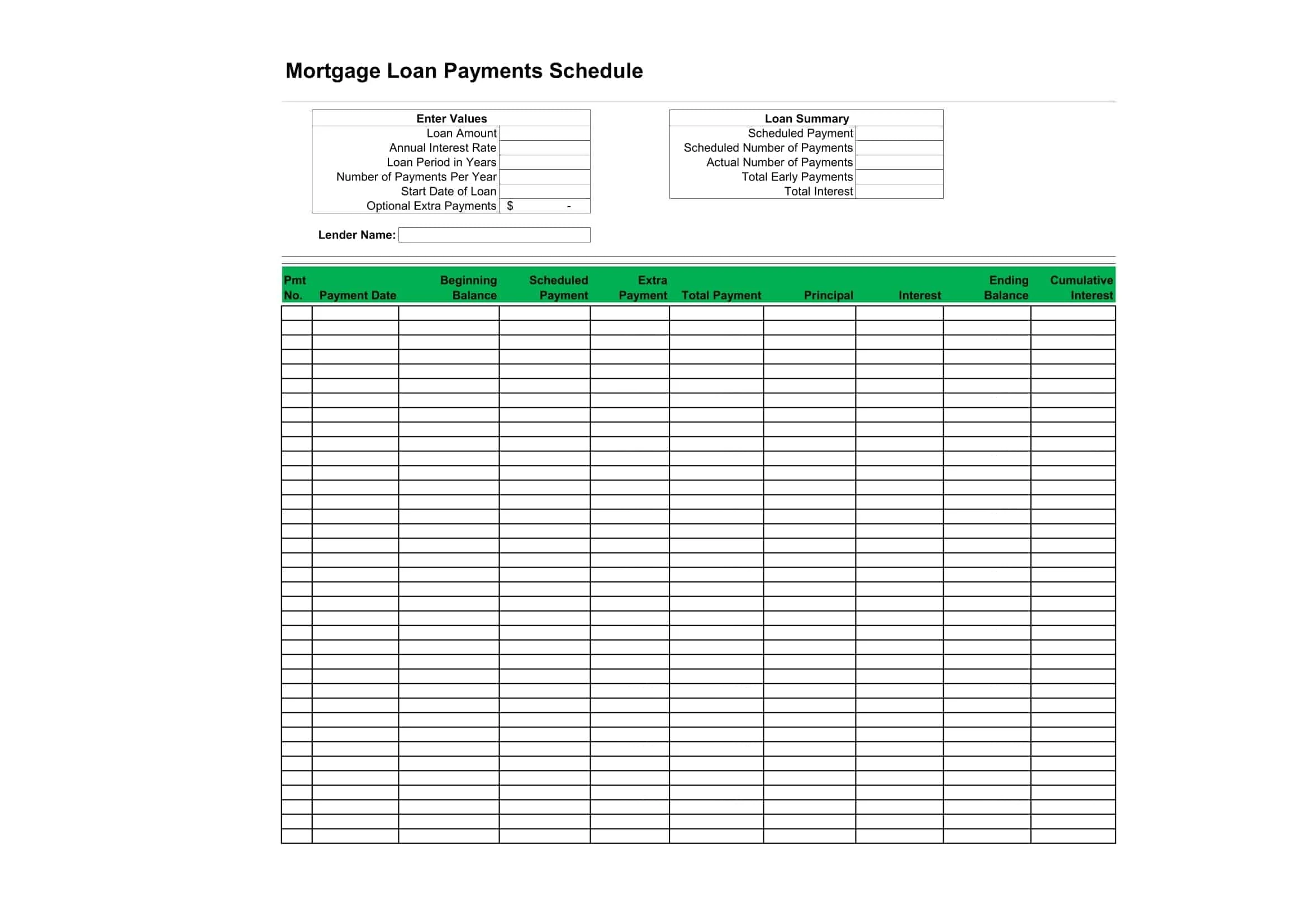

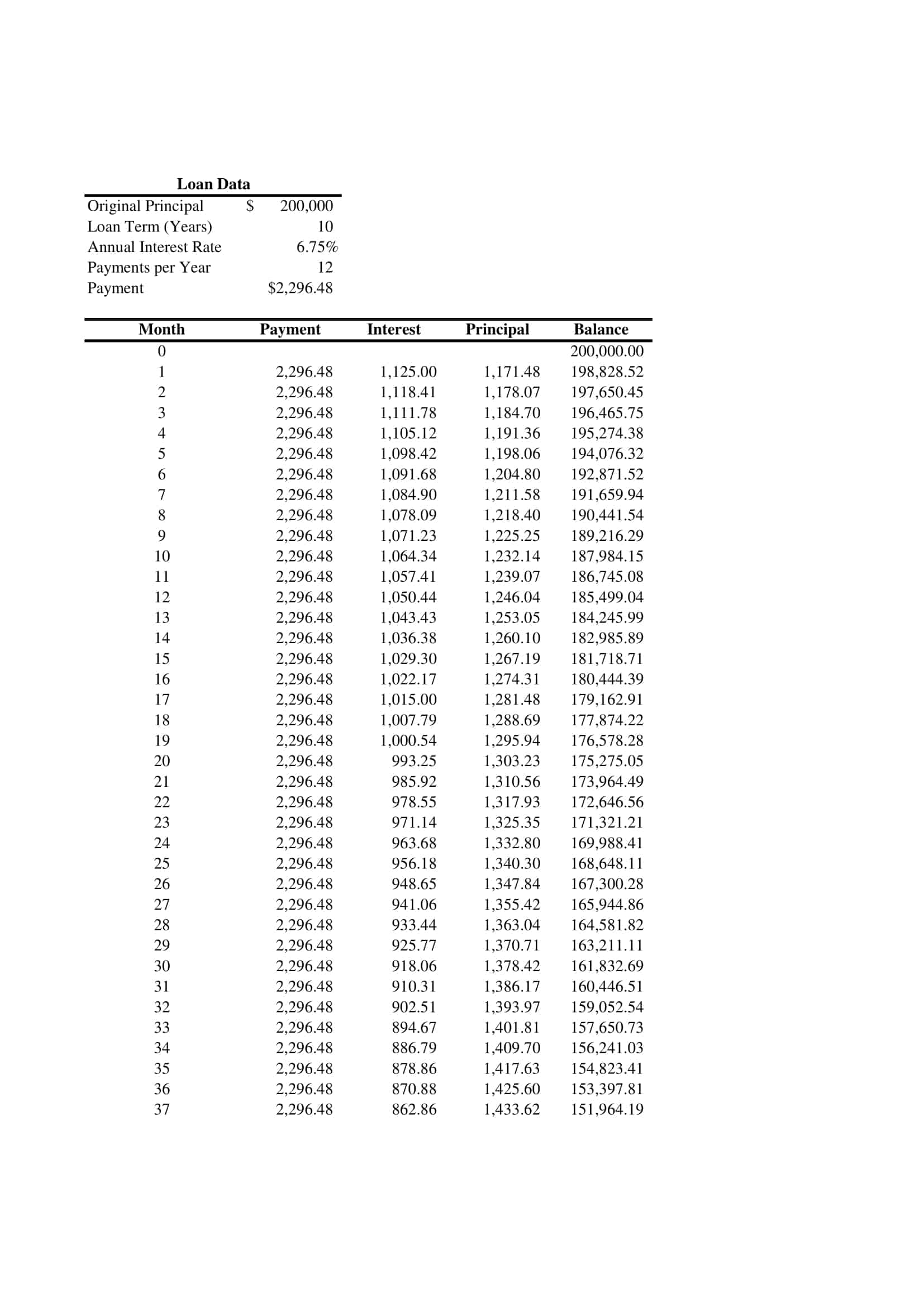

Creating a printable amortization schedule with a start date is a breeze. Simply input your loan amount, interest rate, and term length, and the schedule will calculate your monthly payments, principal, and interest breakdown. You can then print it out and refer to it anytime you need.

By having a visual representation of your loan payments, you can see the progress you’re making each month towards paying off your debt. It can also help you make informed decisions about making extra payments or refinancing to save money in the long run.

Having a printable amortization schedule with a start date can also be useful for tax purposes. You can keep track of how much interest you’ve paid throughout the year, which may be deductible on your tax return. It’s a simple way to stay organized and potentially save money.

So, if you’re looking for a user-friendly tool to help you manage your loan payments and stay on top of your finances, consider using a printable amortization schedule with a start date. It’s a practical and convenient way to track your progress and work towards financial freedom.

Free Printable Amortization Schedule Templates PDF Excel

Free Printable Amortization Schedule Templates PDF Excel