Are you in the market for a new home and trying to figure out your mortgage payments? Understanding your amortization schedule can be a game-changer. But what if you have a down payment? How does that affect your schedule?

Don’t worry, we’ve got you covered. In this article, we’ll break down everything you need to know about printable amortization schedules with a down payment. So, let’s dive in and simplify this financial jargon for you!

Printable Amortization Schedule With Down Payment

Printable Amortization Schedule With Down Payment

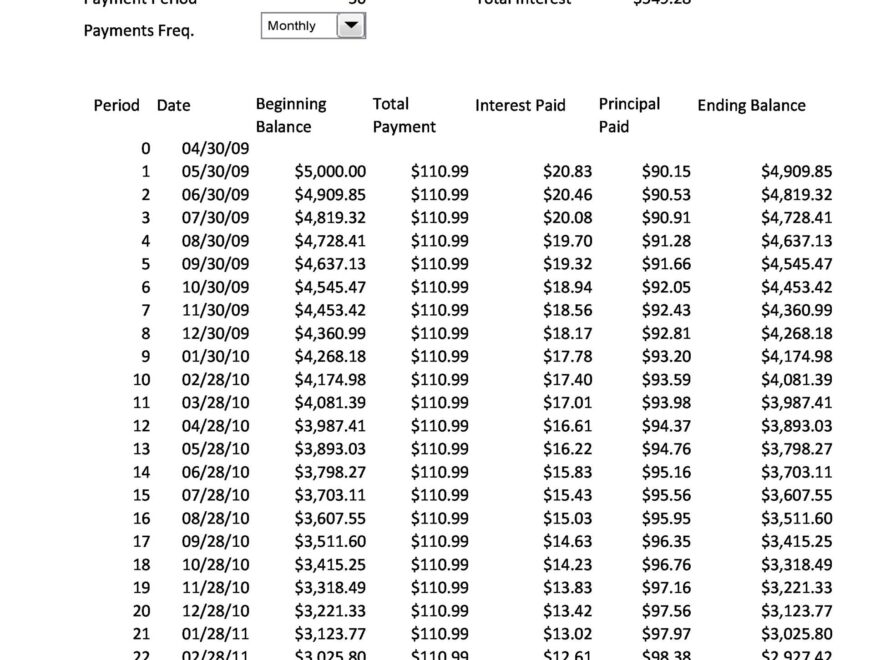

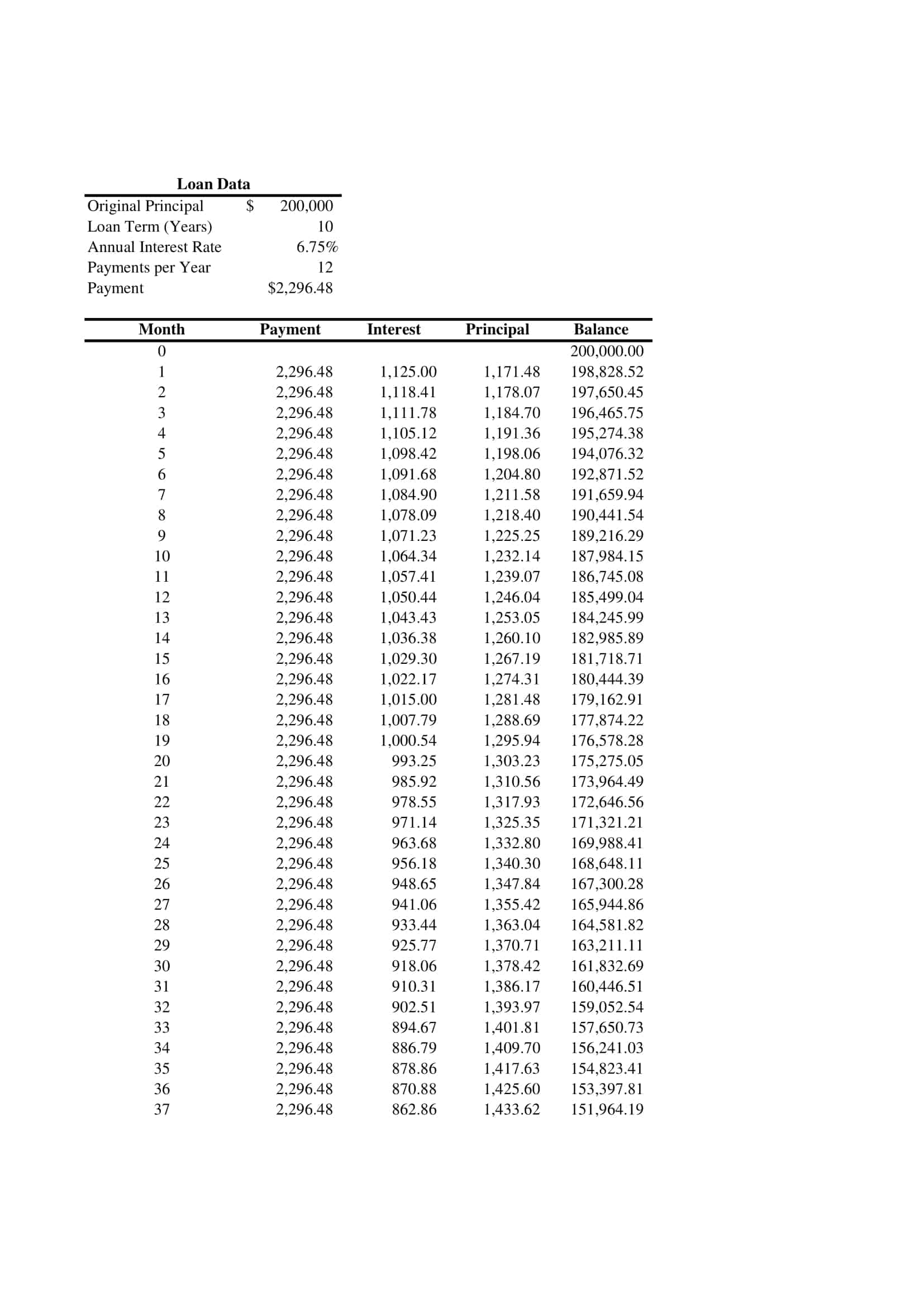

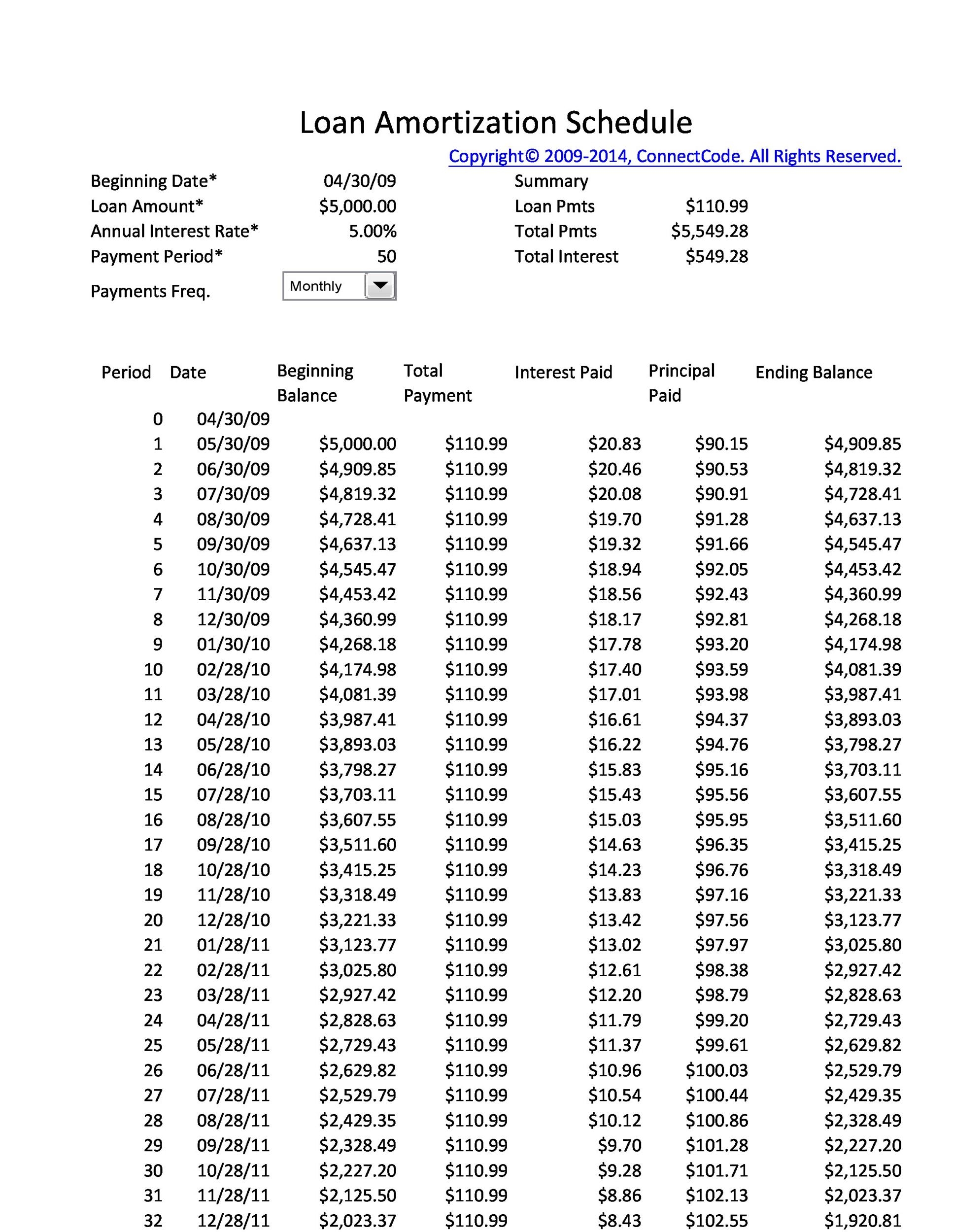

An amortization schedule is a table that breaks down your mortgage payments into principal and interest. When you make a down payment, it reduces the loan amount, which can have a significant impact on your schedule.

Having a down payment means you’ll borrow less money, resulting in lower monthly payments and less interest paid over the life of the loan. A printable amortization schedule can help you see how much you’ll save with a down payment.

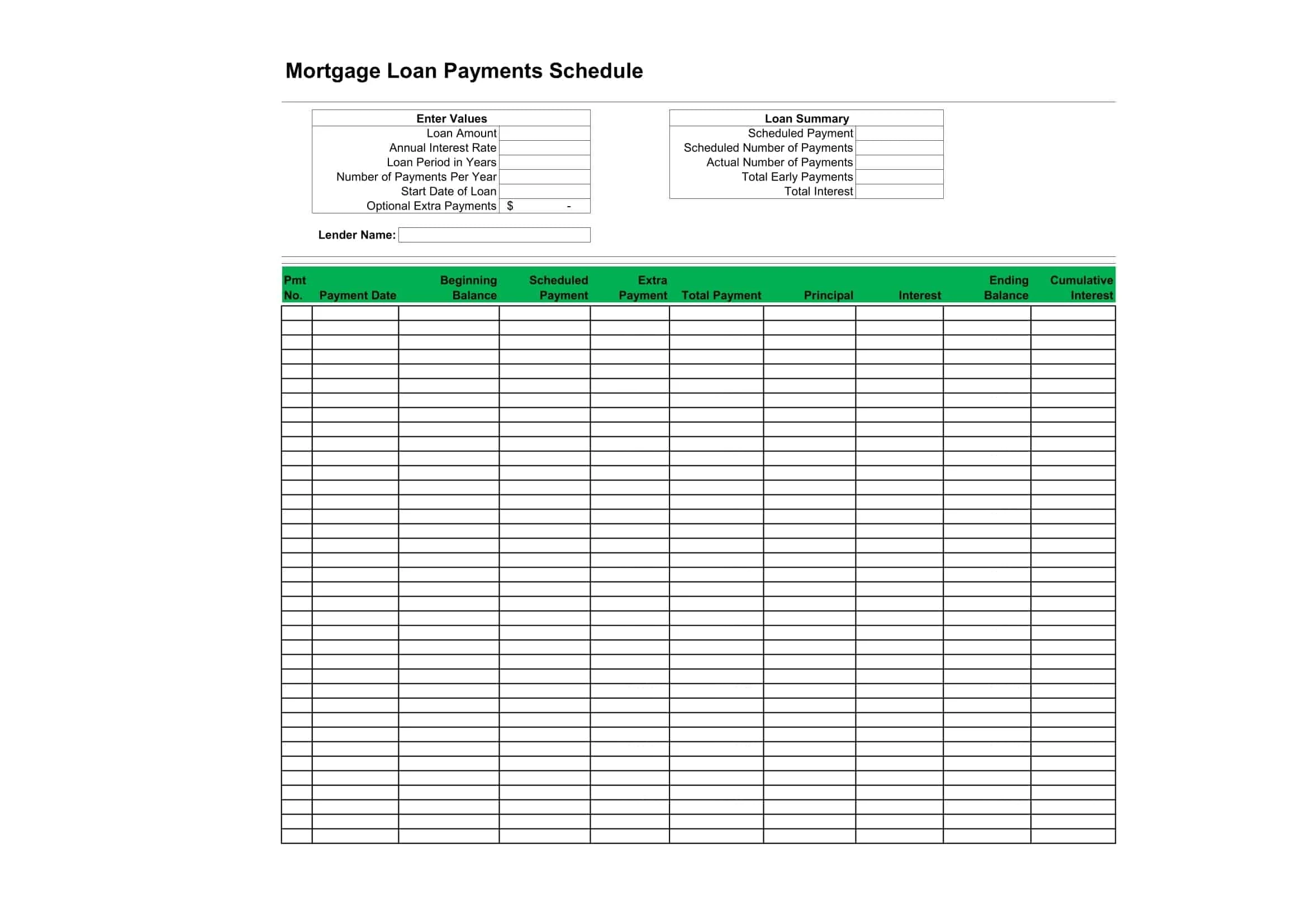

By inputting your loan amount, interest rate, down payment, and loan term into an online calculator, you can generate a printable amortization schedule. This schedule will show you how much of each payment goes towards principal and interest, helping you plan your finances better.

With a down payment, you can also build equity in your home faster, giving you more financial security in the long run. Plus, a printable amortization schedule can help you track your progress and make extra payments to pay off your loan sooner.

In conclusion, understanding how a down payment affects your printable amortization schedule is crucial when taking out a mortgage. By using this tool, you can see the financial benefits of making a down payment and plan your homeownership journey effectively. So, grab that calculator and start crunching those numbers!

Free Printable Amortization Schedule Templates PDF Excel

28 Tables To Calculate Loan Amortization Schedule Excel TemplateLab